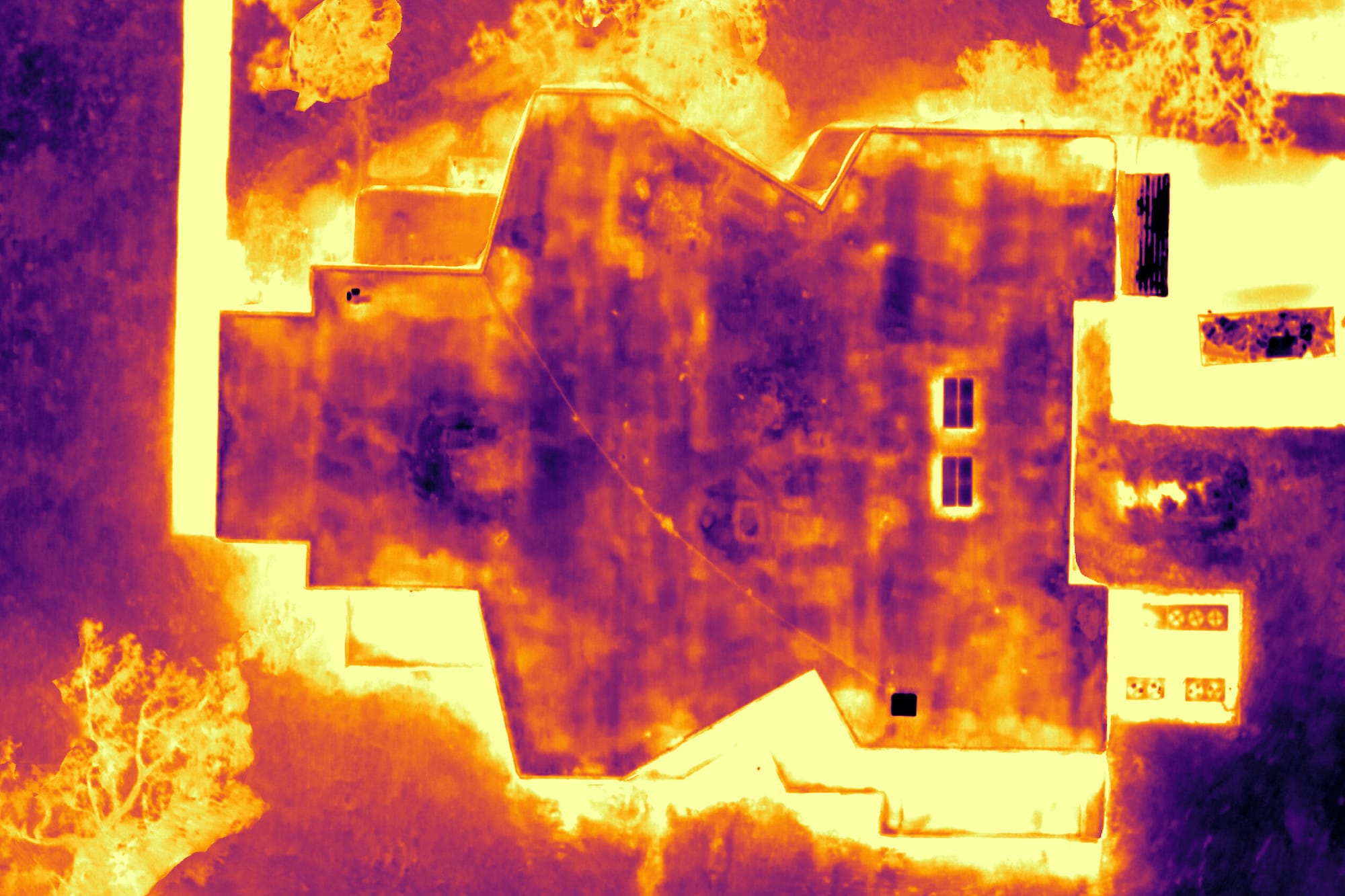

Moisture mapping can identify isolated damage to a roof. It can reveal wind-driven water damage, and other types of water intrusion damage within the roofing system. When it comes to filing and processing commercial insurance claims, it can be a long drawn out process. There are many reasons why it take so long to pay out. The difficulty is identifying the damage present and differentiating what is a pre-existing issue vs. damage created by a weather event. One party might feel one way about the condition while the other opposes it. Moisture mapping services can expedite these types of insurance claims.

Basic Understanding of Insurance

Insurance is a business designed to prevent catastrophic losses for companies and individuals. Insurance companies are businesses who want to help property owners when there are legitimate claims to be paid out. However, they have to protect themselves and their bottom line at the same time. They deal with thousands of claims a year. While most are legitimate and should be paid out, there are cases filed that are fraudulent or not related to a weather event. The insurer must effectively deploy inspection teams to determine if damage is present. They also have to understand the cause of the damage. When policy holders experience unexpected damage to their business or building that affects their bank accounts and bottom line, they expect quick results from the insurance carrier.

Moisture Mapping for Insurance Claims

When processing insurance claims, utilizing a moisture mapping service can prove beneficial. Any engineer that gets brought in on a claim knows the value moisture mapping brings to a case. I have been involved in many insurance claims over the years. In these claims, both the insurance carrier and the policy holder agree that storm damage is present. If it is a wind driven claim, it is not uncommon to find physical damage in an isolated portion of the roof. There is no guarantee that the water intrusion remained in that area just because the external damage is isolated. Depending on the roof construction and the slope of the deck and structure, moisture could have traveled through various portions of the roof. Moisture mapping helps to identify the extent of moisture inside the roofing system and removes guessing.

When considering whether a roof is a total loss or not, moisture damage and openings need to be considered. Using moisture mapping we can see that if the roof is more than 25% damaged, the roof can be considered a total loss and is no longer repairable. For example, if you have a 200,000 square foot TPO roof with known wind creating openings on the surface and the moisture survey calculates an estimate of more than 50,000 square feet of moisture damage, the insurance company would deem it a total loss. If the damage is less than 25%, the carrier will say the roof is still serviceable and should be repaired.

Read more about moisture mapping.