Commercial Property Insurance Claims

Fast and fair solutions for commercial property insurance claims

Working with an insurance claim can be a frustrating and confusing process for everyone involved. Property owners and managers are looking to get their repairs paid for in a timely manner. Insurance companies want proper documentation of the damage and its causes. And legal entities require evidence when claims are not processed agreeably.

When damage strikes, all parties need to conduct due diligence. And in the case of a catastrophic failure, safety and speed are essential. When the facts are collected appropriately, everyone participating in the insurance claim can be treated fairly.

Fast response time

Detailed documentation

Trustworthy data

Streamlined process

Due diligence and reporting for commercial property insurance claims

Structura View provides the necessary due diligence and documentation for a successful insurance claim experience. Immediately after an incident, we can begin with aerial drone surveys to safely collect the initial information.

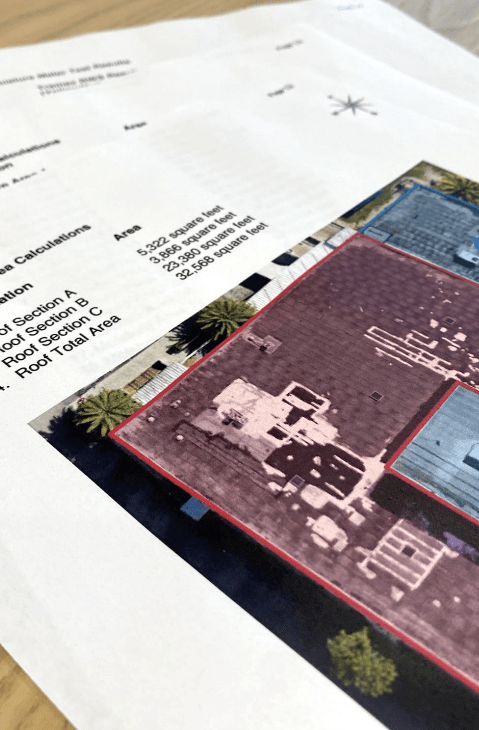

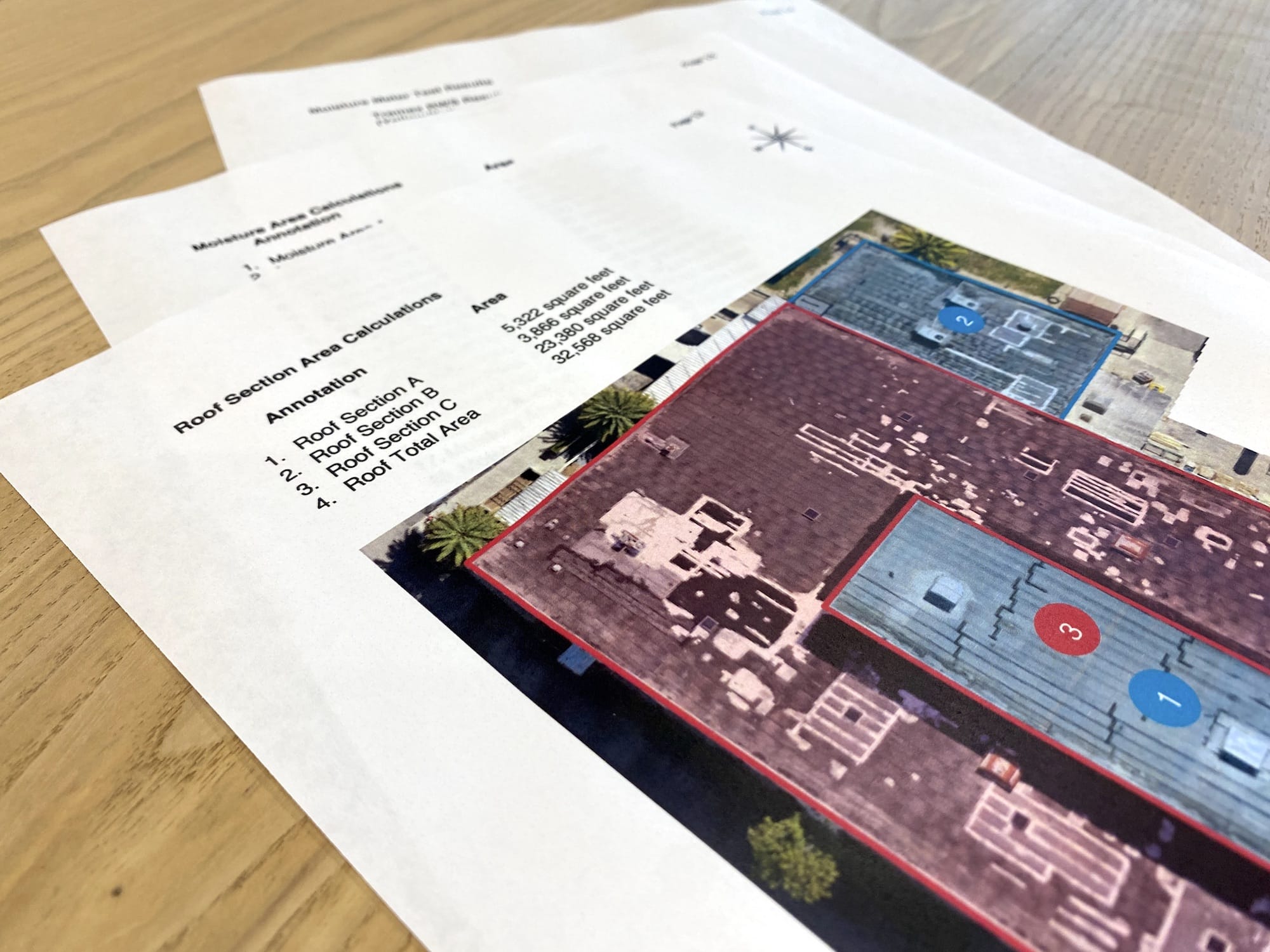

If the insurance claim process becomes more complicated, Structura View will complete on-site inspections and create detailed reports on moisture damage, potential causes of failure, and other issues. These reports can help anyone involved in the claim to make fair and productive decisions.

Building enclosure consulting services for commercial property insurance claims

Routine Commercial Roof Inspections

Routine Commercial Roof Inspections

Visual Drone Inspections

Visual Drone Inspections

Drone Thermal Imaging and Scanning

Drone Thermal Imaging and Scanning

Moisture Mapping for Roofing Systems

Moisture Mapping for Roofing Systems

Detailed Roof Condition & Enclosure Reports

Detailed Roof Condition & Enclosure Reports

Construction Quality Assurance Observations

Construction Quality Assurance Observations

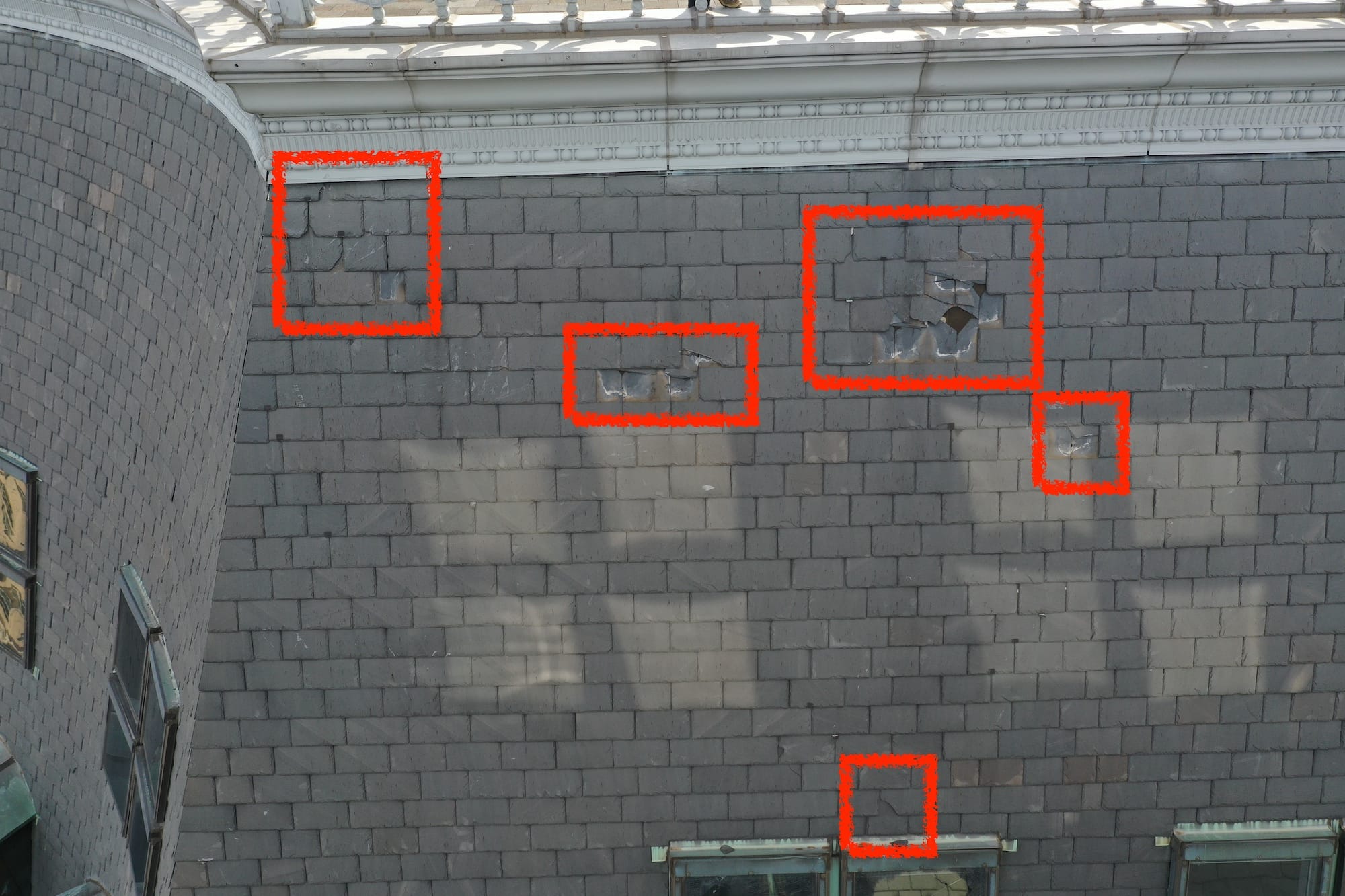

Tornado insurance claim roof inspection reveals extent

of damage

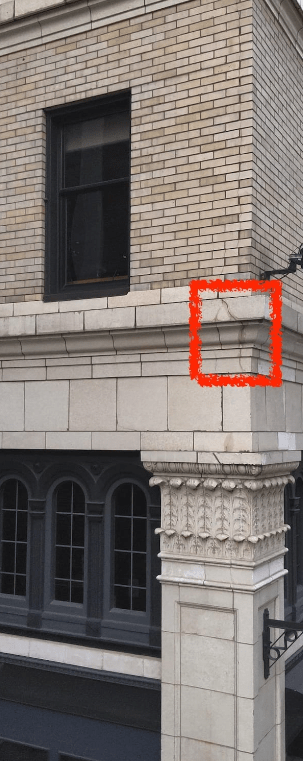

Our team was deployed to perform a roof condition and moisture assessment on a built-up gravel ballasted roof that was affected by a tornado that passed by the building, but did not directly hit it. The building was claimed to have experienced substantial leaks from the weather event from both the roof and glazing system.

From the visual assessment, one major wind created opening was observed in the roof that allowed moisture to get into the building. While there was only 1 opening observed in the roof system, the moisture survey revealed that 27% of the roof system was wet. Due to the amount of damage observed, the roof system ended up being paid out as a full replacement claim.